How much equity do I have in my home?

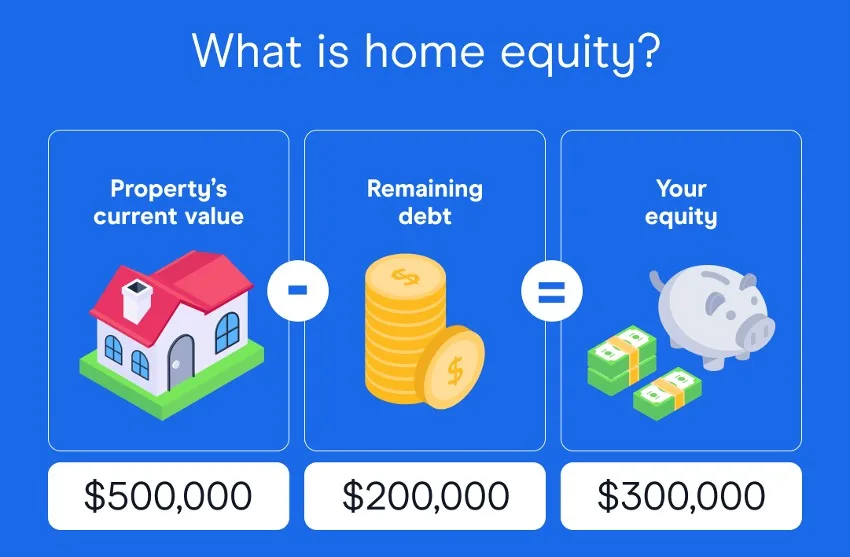

Equity is the value of your property minus any debts. It's the amount of the property you own and is expressed as a dollar value. Here's a simple example:

- Your property is valued at $1,000,000.

- You have $700,000 remaining on your home loan.

- The property value minus debt = $300,000 in equity

Your home equity in this scenario is $300,000. Now, equity calculations are always hypothetical to some degree. The value of your property changes over time and you can't really know what it's worth until you sell it. And these quick calculations don't consider things like selling costs (real estate agent commissions, conveyancing fees etc).

Here's a simple visual explanation of the concept of home equity.

Over time, your equity should grow as you pay off your debt. The other factor affecting your home equity is the property's value. In a rising market, your equity increases by itself as the value of the property grows.

Property owners can use their home equity through line of credit loans or other loan products. This allows you to borrow against the equity to fund investment property purchases, renovations, retirement costs and more.

How do I calculate my home equity?

The calculation, as explained above, is simply the property value minus any debt on the home. You can use this simple calculator to estimate your equity. Just enter the following information:

- An estimate of what your property is currently worth.

- How much of your home loan is left to repay.

When estimating your equity, it is important to consider the current property value rather than the price you paid for it. If you bought a home 5 years ago for $650,000, in a rising property market, it could now be worth $700,000.

To get an accurate picture of your remaining debt, check your most recent home loan statement or log onto your lender's banking platform and check your loan account.

How can I use the equity in my home?

There are several finance options property owners can use to unlock the equity in their homes, ranging from line of credit loans to home loan top-ups and, for older Australians, reverse mortgages.

- Line of credit loan. A line of credit loan allows home owners to borrow money against the equity in their property. The lender approves a certain amount of money based on your equity and charges you interest based only on the money you actually spend. It's a flexible way of using some of your home equity. But keep in mind that interest rates on these loans are higher than regular mortgages. The more you spend, the less equity you will have.

- Refinance. If you're currently paying off a mortgage, it's possible to switch to a new home loan with a new lender. This is called refinancing your home loan. You can do this to switch to a cheaper home loan with a lower interest rate. But when you switch, you can also use your equity to borrow slightly more with the new home loan.

- Home loan top-up. Instead of refinancing, you can stick with your existing loan and lender but apply for a home loan top-up. This means keeping the current loan but extending your borrowing limit slightly further.

- Reverse mortgage. Australian home owners who are aged 60 or older can borrow some of their equity using a reverse mortgage. Interest is charged on what you borrow, and you repay the debt when you sell the property or die. This option can be used to fund your retirement costs, supplement your income or for anything else you need.

Need professional guidance on unlocking your equity? Chat to a broker.

What can I use home equity for?

Equity is your wealth. In theory, you can spend it on whatever you want. But sometimes a lender may restrict what you can spend the money on, depending on the type of loan you get.

You can use your home equity for the following:

- Renovations. Big home renovations are expensive but are a great way to improve and add value to your home. You can use your equity to effectively build more equity.

- Financing major purchases. You can pay for a holiday or a car through your equity.

- Investing in property. With enough equity, you could cover the deposit on a second property and then rent it out.

Finder survey: Why do people refinance their home loan?

| Response | Female | Male |

|---|---|---|

| A better interest rate | 5.08% | 4.24% |

| Lower fees | 2.2% | 1.73% |

| To reset the loan term | 1.69% | 0.96% |

| A cashback or other incentive offer | 1.19% | 1.35% |

| Better/more features | 0.51% | 1.35% |

| Better overall cost | 1.19% | 0.58% |

| Other | 0.17% | 0.96% |

| To move to a different brand | 0.68% | |

| None of the above | 0.17% |

Are there any risks that come with using your equity?

Borrowing your equity reduces how much of your home you own. If you borrow too much, you risk going backwards on your home loan repayments.

Lenders limit how much equity you can access, which gives you some protection. But any borrower looking to cash out some of their equity should know the following:

- Borrowing your equity adds to your debt. You will have to repay the equity, plus interest, along with your normal mortgage repayments.

- Interest rates on line of credit loans are higher than ordinary home loans. This means even if you borrow a small amount of equity, the interest charges might be bigger than you think.

- If you don't have much equity and the property market is in a downward cycle (prices are falling), you might have less equity available than you think. And borrowing some of it risks tipping you into negative equity.

How can I increase the equity in my home?

Home equity increases in several ways. Growth can be passive (if your property value grows over time in a rising market), but you may be able to add value to your property through renovation.

- Repayments. As you pay off your home loan, you are adding to your equity. If you started a home loan with a 20% deposit, you'd have a loan to value ratio of 80%. After 5 years of diligently repaying your loan, you could be at 70% LVR and 30% equity. Keep in mind this only works if you have been making principal and interest loan repayments. You can build your equity faster by making extra repayments.

- Capital growth. Over time, property prices in Australia tend to grow. This is called capital growth. According to CoreLogic's Home Value Index, the median Sydney property value in September 2016 was $785,000. In September 2020, the Sydney median stood at $859,943. That's $74,943 in equity a median property would have gained over those 4 years. Of course, there are exceptions, and prices can fall over time too, so passive equity growth through capital growth is never guaranteed.

- Renovations. Property owners can increase the value of their properties through renovation. Adding an extra room to a house, redoing a kitchen or bathroom or even just a fresh coat of paint can make your property more appealing to buyers, increasing its value.

Why you can trust Finder's home loan experts

You pay nothing. Finder is free to use. And you pay the same as going direct. No markups, no hidden fees. Guaranteed.

You pay nothing. Finder is free to use. And you pay the same as going direct. No markups, no hidden fees. Guaranteed.

You save time. We spend 100s of hours researching home loans so you can sort the gold from the junk faster.

You save time. We spend 100s of hours researching home loans so you can sort the gold from the junk faster.

You compare more. Our comparison tools bring you cheaper, better home loans from across the market.

You compare more. Our comparison tools bring you cheaper, better home loans from across the market.

More guides on Finder

-

How to get a home loan in Australia

Taking out a home loan can seem like a huge mountain to climb. But when you break it down into these 10 key steps, it becomes much easier.

-

Why did my home loan interest rate change?

Read this guide and learn more about the reasons why lenders are making upward rate moves outside of the RBA.

-

Investment property tax deduction

Investment property tax deductions can be worth thousands of dollars – don't pay tax when you don't need to!

-

What is a redraw facility?

Here's what borrowers need to know about home loans with redraw facilities.

-

Household Capital home loans

Read our detailed review of reverse mortgage lender Household Capital.

-

Investment home loan rates – grab a cheap ticket to landlord town

The best investor home loan rates that have been offered in years have hit the market. Compare investment property loan rates today.

-

Fixed versus variable home loan: Which is right for you?

Variable vs fixed home loan - which one saves you more money? We show you how to compare rates and features to get the best deal on your mortgage.

-

Cheap home loans from 5.59% to save & stash cash

Find the cheapest home loan rates and learn how to decide which one best fits your needs and will save you the most money.

-

Best variable rates – turn on the offset

Find a great deal on a variable interest rate home loan from lenders large and small. Start comparing and saving today.

-

Best home loans with offset accounts

What is an offset account? It can save you thousands in interest and help you own your home sooner.

Ask a question